The Cold War 2.0 is going hot, and while it may someday be fought with planes, tanks, guns and bombs, the first front is being fought with oil and shale gas.The U.S. and European sanctions against Russia have become very severe and crippling in the face of drastically falling oil prices – prices which are falling drastically because of the unprecedented boom of shale gas fracking both domestically in the U.S. and abroad in Ukraine and other locales. The oil & gas giants like Chevron and Exxon Mobil have created revolutionary conditions with now direct consequences on U.S. foreign policy and global war for dominance.

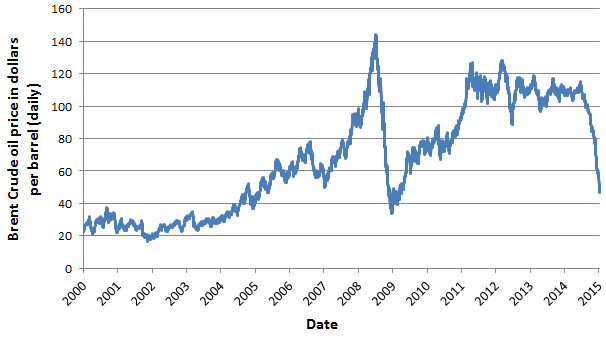

Oil's decline is proving to be the worst since the collapse of the financial system in 2008 and threatening to have the same global impact of falling prices three decades ago that led to the Mexican debt crisis and the end of the Soviet Union. Russia, the world's largetst producer, can no longer rely on the same oil revenues to rescue an economy suffering from European and US sanctions.

The destabilization in Ukraine and numerous spots in the Middle East – including the ISIS-threatened Iraq and Syria – have been mere preludes to what is coming.The OPEC countries, led by Saudi Arabia, are allowing oil prices to fall drastically, in clear coordination with its Anglo masters, and in response to the sudden rise of shale gas production obtained through fracking. These Arab states will not lose power with the falling oil prices, while many other regimes will face pressure in all sectors.

Targeted at the center of this web of intrigue is, of course, Russia. Natural gas is at the center of the Ukrainian conflict – with Russia’s Gazprom supplying some 25% of Europe’s natural gas. U.S. operatives are working overtime to undermine that by cutting off Russian gas and supplying Europe, instead, with booming shale gas from fracking in and around Ukraine and its rich mineral holdings. Between rising U.S. domestic production, falling OPEC oil prices and U.S.-led production and exploration in Ukraine, gas could prove a trump card against Russia, though Putin has downplayed these consequences. An important secondary consequence of falling oil prices will come in the form of disruptions to social services in countries that have been supporting citizens with money from high oil prices – including Russia, Iran, Venezuela, Nigeria and others.

The “sudden rise” of shale natural gas has been a planned, coordinated and highly strategic move. Plummeting oil prices are indeed an economic weapon against Russia, as many analysts have shown, and act to call the bluff of the other players at the table as well. It poses serious challenges to tensions with Russia, and will have immediate consequences for many other economies based on oil.

Bloomberg explains the positions.To be sure, not all oil producers are suffering. The International Monetary Fund in October assessed the oil price different governments needed to balance their budgets. At one end were Kuwait, Qatar and the United Arab Emirates, which can break even with oil at about $70 a barrel. At the other extreme: Iran needs $136, and Venezuela and Nigeria $120. Russia can manage at $101 a barrel, the IMF said.“Saudi Arabia, U.A.E. and Qatar can live with relatively lower oil prices for a while, but this isn’t the case for Iran, Iraq, Nigeria, Venezuela, Algeria and Angola,” said Marie-Claire Aoun, director of the energy center at the French Institute for International Relations in Paris. “Strong demographic pressure is feeding their energy and budgetary requirements. The price of crude is paramount for their economies because they have failed to diversify.”

The BRICS have been succesful in undermining the use of the Petrodollar in places like Iran and Venezuela. The Petrodollar is on the ropes. However, with these low oil prices, the worm has turned and the major reason that Russia and her allies are under an economic attack is due to the Ukrainian situation. Ukraine was pivotal in Putin's desire to rebuild the Soviet Union empire because 60% of Russian gas flowing in to Europe, first flows through Ukraine. Conversely , the Western banking establishment wants Ukraine to join the European Union and, as such, control the price and flow of gas. Both sides are willing to sponsor a civil war in Ukraine and risk World War 3. Putin has effectively stalemated the West and the West has retaliated with low oil prices If events continue in the present direction, we could witness an economic collapse that will come like a thief in the night unparalleled civil unrest and movement down the road towards World War 3. In short, low oil prices could indeed lead to World War 3.

No comments:

Post a Comment